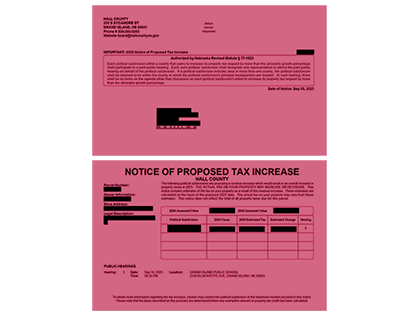

NOTICE OF PROPOSED TAX INCREASE POSTCARDS

Hall County

Joint Public Hearing

| If you live in Hall County, you may receive a special postcard. The postcard is not a tax bill. The postcard shows the estimated change in your property taxes as well as the political subdivisions levying those taxes. Anyone can attend the public hearing(s) listed on the postcard to learn more about the budgeting process and make public comments before the political subdivision adopts the levy for the next fiscal year. Attendance is not required. |

|

Frequently Asked Questions

Why did I get a postcard? State law requires a postcard to go to all property owners within political subdivisions that are asking for more in tax revenues, by a certain amount, than they asked for the previous year. How are property taxes calculated? Property taxes are determined by multiplying the property’s taxable value by the tax rate for the tax district in which the property is located. The tax district for a property includes various local authorities which levy property taxes for services. How does this impact the property taxes that I already paid this year? This does not impact the 2024 property taxes you paid this year. This postcard is notifying owners of estimated changes to certain levies within their property tax bill that will be paid next year. Keep in mind, property taxes are paid in arrears. During the calendar year 2025, property owners paid their property taxes for 2024. During the calendar year 2026, property owners will pay their property taxes for 2025. I only have one public hearing listed on my postcard. Are there supposed to be two? If you only have one public hearing listed on your postcard, all the political subdivisions listed in your postcard are headquartered in Hall County, and representatives from those political subdivisions will be participating in the same public hearing. For those who received postcards with two public hearings listed, that means a taxing authority is headquartered in another county, and a representative from that taxing authority will be participating in the joint public hearing in the other county. Are these political subdivisions voting on their tax rates at this joint public hearing? No. At the joint public hearing, a representative from each political subdivision will give a brief presentation on that political subdivision's intent to increase its property tax request by more than the allowable growth percentage and the effect of such request on the political subdivision's budget, but there will not be any votes taken after the presentations. For the political subdivisions participating in this joint public hearing, their participation in this joint public hearing is required BEFORE the political subdivision can file their adopted budget statement. If I attend the Joint Public Hearing, will I have an opportunity to speak? Yes, there will be a public comment period after the political subdivisions have finished presenting. Those speaking from the public will be limited to two minutes. The Hall County Clerk, who is charged with organizing this public hearing, may adjust the time limit depending on how many speakers are present. While the public comment period is the opportunity for members of the public to speak during the hearing, there will not be back-and-forth discussion between members of the public and representatives from the political subdivisions. |

.png)

Twitter

Twitter